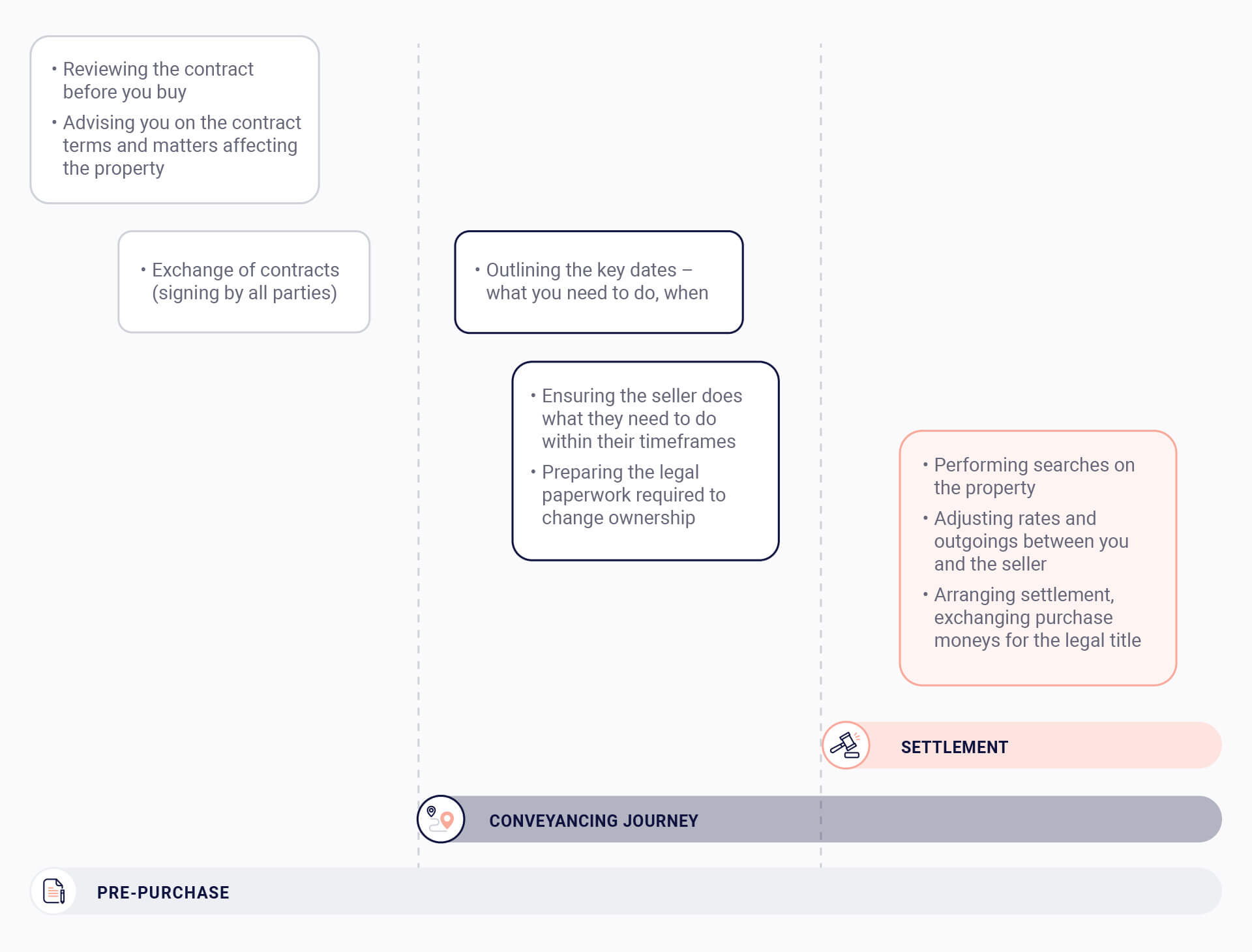

Now that you know a bit about conveyancing (From our article: “What is conveyancing?” A simplified guide for homebuyers) we will now provide more insight into the role of your licenced conveyancer or conveyancing solicitor when buying a property.

A buyer that fails to meet their legal obligations during a conveyancing transaction can face serious financial consequences. You will need the services of an experienced conveyancer or solicitor to complete the change of ownership on your behalf.

The agreement to purchase a property will be formalised in a contract between yourself and the seller.

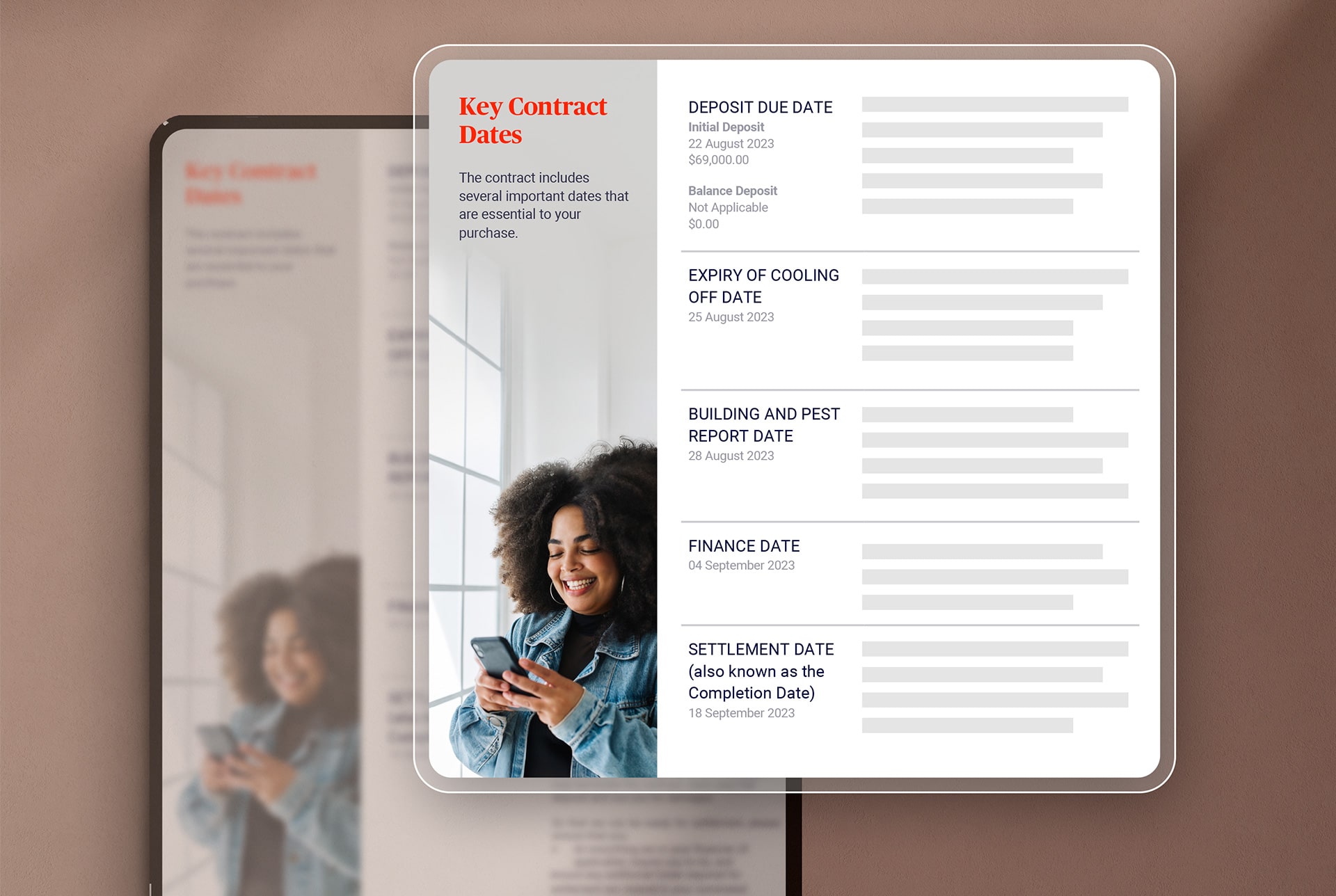

There are usually strict timeframes for completion of tasks and key dates, such as:

- payment of deposit;

- satisfaction of key conditions such as finance and building inspections;

- preparation of legal paperwork for co-signing by the seller; and

- payment of the balance of funds at settlement.

Importantly, penalty interest and legal costs will apply if you breach the contract (such as the deposit due date) and serious risks apply for serious breaches.

Don’t risk your deposit with an unexperienced conveyancer!

The government also monitors a range of tax withholding schemes for the sellers’ funds which must be followed at settlement, failure to withhold (when required) can result in penalties to you as buyer. You should always appoint a competent and experienced conveyancer to ensure that all your obligations are met.

Your conveyancer or solicitor will complete a range of tasks on your behalf and guide you through the process.

Conveyancing.com.au have an experienced team of conveyancers, solicitors and paralegals ready to assist you with your purchase journey.

This article is provided for general information purposes only. Its content is current at the date of publication. It is not legal advice and is not tailored to meet your individual needs. You should obtain specialist advice based on your specific circumstances before taking any action concerning the matters discussed in this article.