How do I make the offer?

If the seller is using a real estate agent to manage the sale, you will communicate and make an offer directly with the selling agent.

The agent may start by relaying verbal or written offers.

The agent will present your offer to the seller (unless the seller has instructed them not to, such as declining to consider pre-auction offers).

The agent will likely ask that you formalise your offer by signing a contract of sale; if co-signed by the seller this will become the binding agreement without scope to later change terms and conditions.

Can I add or negotiate conditions to the contract?

For private sales, your offer may be conditional on certain items being satisfied, such as subject to obtaining unconditional loan approval (“subject to finance”), subject to a building and pest inspection or sale of your own property.

You must ensure that any required conditions are in the contract before you sign or they won’t be legally binding.

Should I get legal advice before signing?

Before signing a contract, you should obtain a contract review and advice on conditions to ensure you understand the way they apply and their limitations.

Click here for more information on our peace-of-mind contract reviews.

How will I know if the seller accepts my offer?

The agent may verbally communicate the acceptance with you.

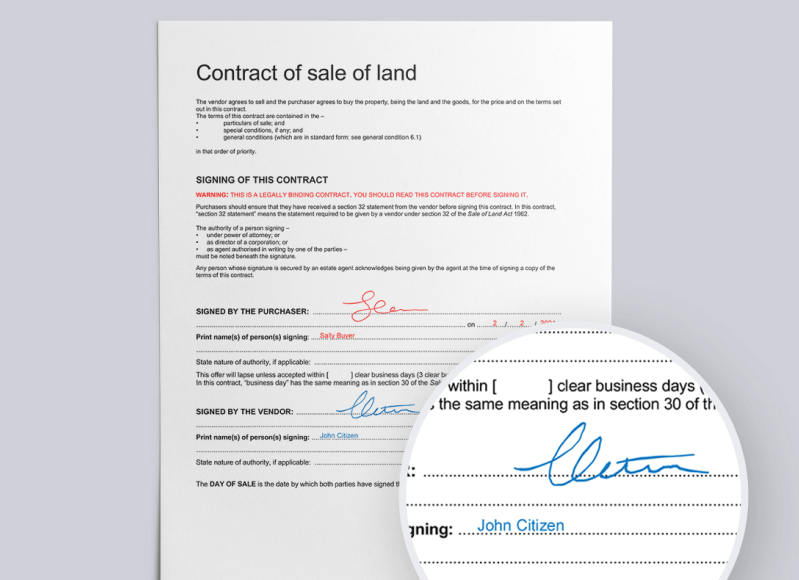

However, until contracts are fully signed contracts are exchanged the sale of the home isn’t finalised.

This means that you or the seller can pull out of the sale, and the seller may negotiate with other buyers for a higher offer.

The selling agent is obliged to work in the best interests of the seller and may use multiple offers to result in better terms for the seller.

It is recommended that you clearly stipulate the in the contract the timeframe for your offer to lapse if you intend to make offers on other properties. In Victoria it is standard for a seller to have 3 clear business days to co-sign the contract and accept your offer.

Your cooling off period (if applicable) will commence from the date you sign the contract.

Click here for more information on cooling off.

If the seller is managing the sale themselves privately, you will communicate and make offers directly with the seller. Any negotiations over terms will be made with the seller directly.

Depending on the agreed terms, an initial deposit will be payable directly to the selling agents trust account (or if no agent, the sellers’ solicitors trust account).

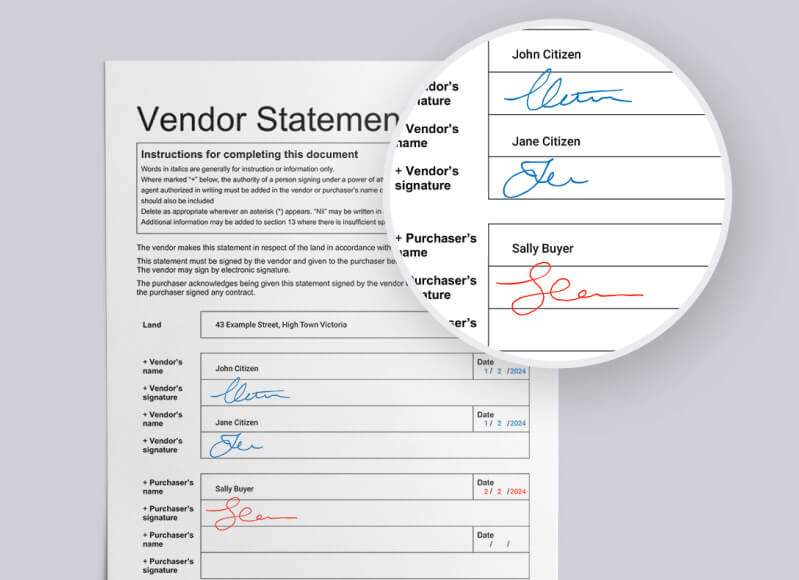

Step 1

Step 1

Section 32 provided to buyer/s

VENDOR signs the disclosure statement prior to accepting written offers.

Step 2

Step 2

Buyer signs

PURCHASER will sign to acknowledging receipt of disclosure statement and sign the Contract of Sale with their offer terms.

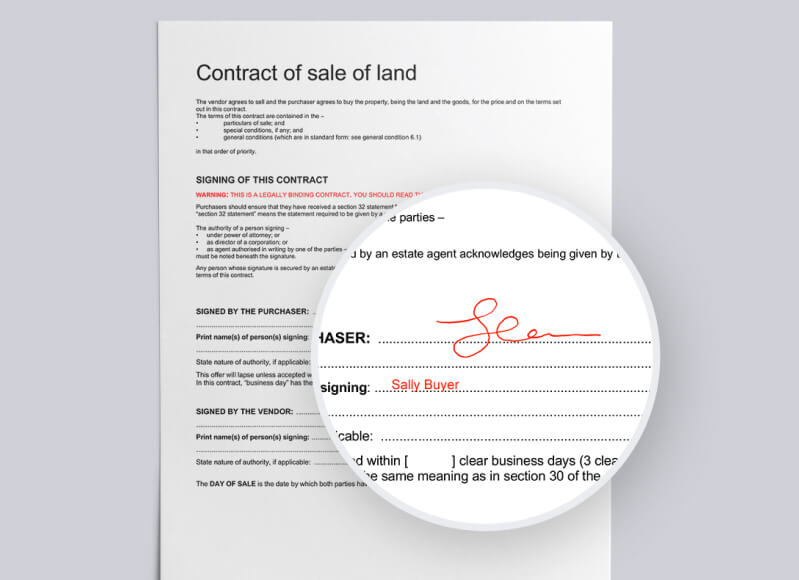

Step 3

Step 3

Seller signs

VENDOR signs the Contract of Sale to accept the offer terms.

Buying at AUCTION

You should have the contract reviewed prior to attending the auction and understand the general rules for the conduct at the auction.

You should perform all due diligence prior to attending the auction and ensure you have suitable finance for both payment of the deposit and settlement.

When you buy at auction, you cannot put conditions on the contract – for example, a longer settlement period or smaller deposit- without the seller’s prior agreement. If you require any amendments to the contract, these must be negotiated and agreed prior to bidding at the auction.

Click here for more information our peace-of-mind contract reviews.