Buying property in Victoria is exciting but there is more to a property purchase than simply agreeing to a price. Behind-the-scenes of every successful property sale is a conveyancing professional ready to guide you through your journey beginning with the contract review.

Although the rules and procedures relating to conveyancing are often consistent throughout Victoria, every property (and contract) is different. So, it’s important to understand what applies to your specific property.

Once your signed contract has been exchanged it becomes a legally binding agreement. Ensuring you understand what you are signing is critical and will help you avoid any costly mistakes.

Always read the contract prior to signing and seek advice and assistance from a conveyancing specialist.

What’s reviewed in a contract of sale in Victoria?

Your licenced conveyancer or lawyer can review the purchase contract by checking and guiding you on all the key components, special conditions, general conditions and vendor disclosures affecting the property.

With our peace of mind review services, Conveyancing.com.au will make sure you aren’t signing a contract with unusual conditions or hidden, unwanted surprises. We can also propose changes that are specific to your

needs, such as a negotiating settlement conditions, or specific inclusions and exclusions you wish to incorporate.

Learn more about the role of your Conveyancer when buying in Victoria.

What does a contract of sale include?

A contract of sale must contain several key details, including:

- The details of both the vendor (seller) and purchaser (buyer);

- The property address and the legal description of the land (land title particulars);

- The purchase price and terms for payment of the deposit;

- The settlement (completion) date;

- Details of inclusions or exclusions of fixtures and fittings being sold with the property.

- Whether the property is sold as ‘vacant possession’ or ‘subject to a lease’.

There may be additional special conditions agreed between the parties such as building inspections and subject to finance approval conditions.

Vendors statement: seller disclosure to buyers in Victoria

If you are buying a property in Victoria, the seller must provide you with a Section 32 Vendor Statement prior to signing Contracts.

This important document is a key part of any Victorian real estate transaction. Put simply, it’s a disclosure statement that the vendor gives to any interested buyer.

Some examples of what must be disclosed in the section 32 vendor statement include:

- Any mortgages or debts charged against the land

- Any easements, covenants, restrictions affecting use of the land

- Planning information any notices/decisions from authorities affecting the land

- Any building permits obtained in the past 7 years.

- Information relating to any Owners’ Corporation (if applicable)

- Any growth area infrastructure contribution to the land

- Disclosure of services connected to the property, (gas/water/sewerage/telephone/electricity).

The right time to sign a contract

The contract of sale should only be signed after a careful contract review – and this is why you should work with an experienced conveyancing team.

Reviewing the contract of sale prior to purchasing may open your eyes to potential issues before you make a deep emotional connection with the property.

Whether you are a property investor, or looking for your own place to call home, a property transaction is a significant financial decision that should be treated with due diligence.

Why choose Conveyancing.com.au for your contract review?

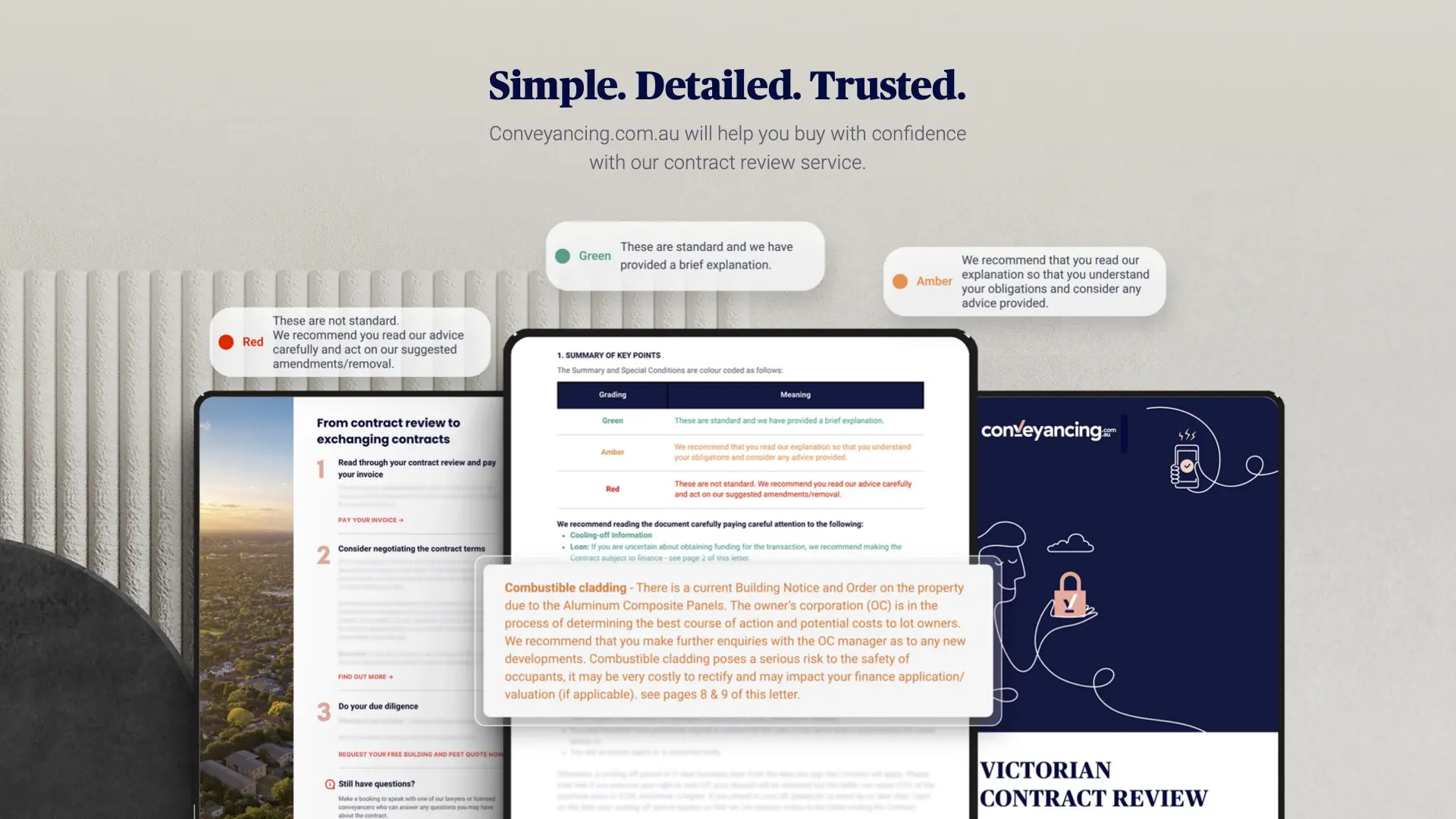

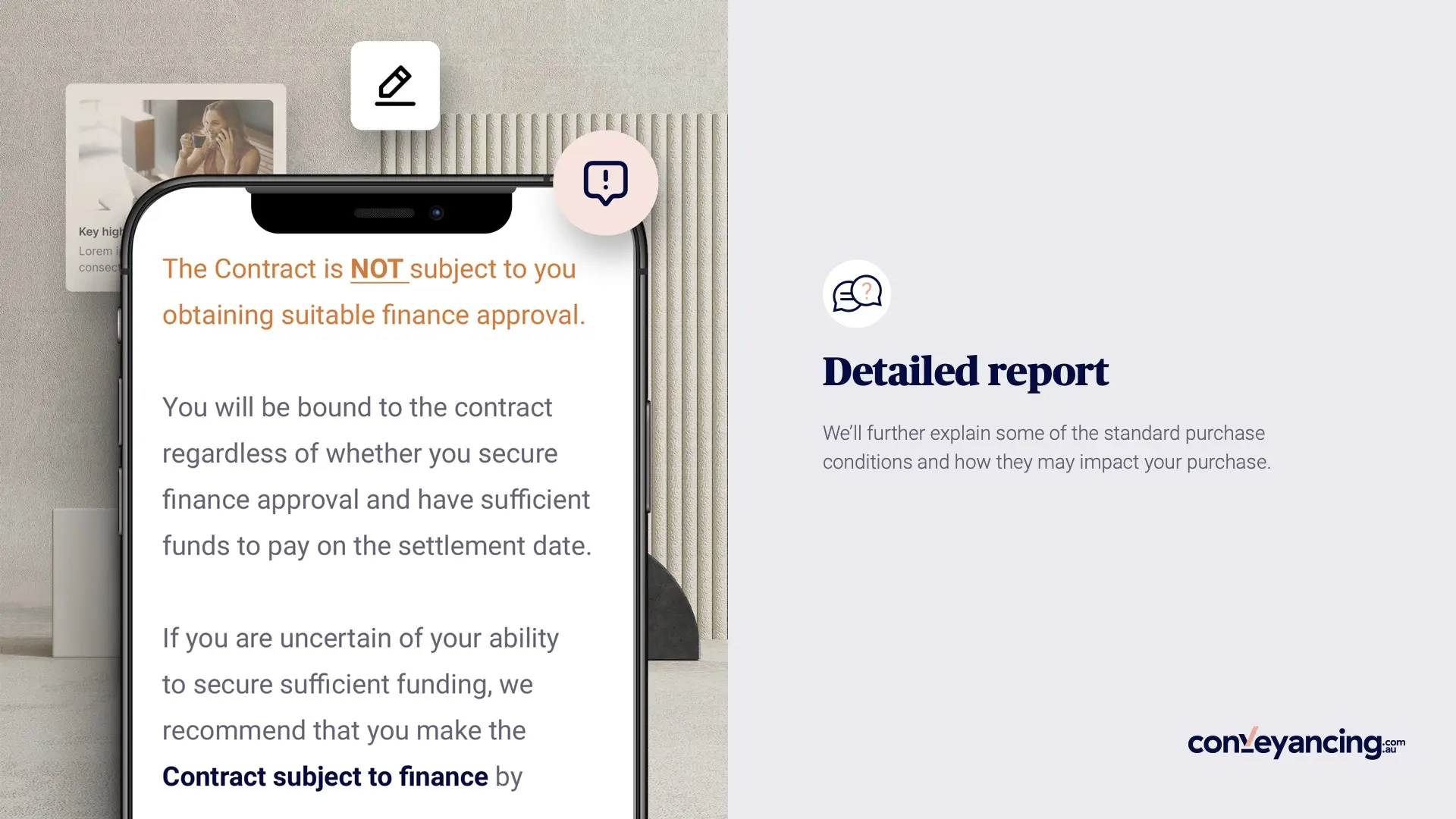

Our review advice is prepared with you in mind! We provide easy to understand and clear advice, colour coded and in plain English.

By helping you understand standard purchase conditions and what ‘normal’ looks like, we will provide greater insight into any special conditions and terms you may wish to negotiate.

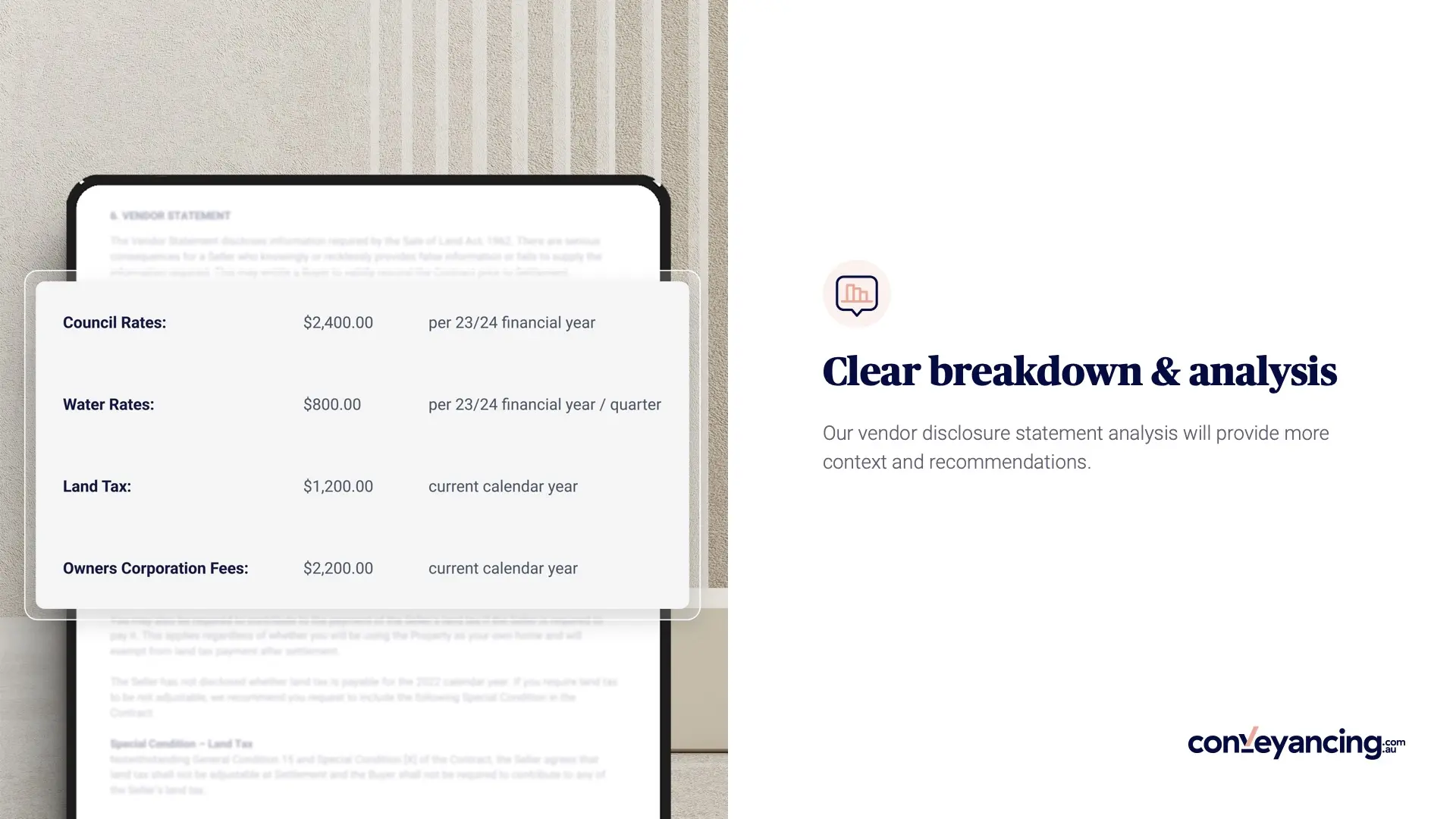

There is a lot to consider when buying a property! A vendor’s statement can often include 10+ attachments and might be 100+ pages long! Your conveyancing team can provide a clear breakdown and anaylsis, capturing the critical information in an easy to read summary so you are not overwhelmed with information.

Conveyancing.com.au is here to be your partner from your contract review all the way to settlement.

This article is provided for general information purposes only. Its content is current at the date of publication. It is not legal advice and is not tailored to meet your individual needs. You should obtain specialist advice based on your specific circumstances before taking any action concerning the matters discussed in this article.